Navigating the investing world can feel like sailing through uncharted waters, but understanding a few essential principles can transform your approach. Imagine standing at the helm, equipped with the knowledge to make confident decisions.

Investing is not merely about buying and selling; it’s a strategic art form. Relying solely on past performances is like predicting the weather based on last year’s forecast—it’s a gamble. Instead, savvy investors analyze robust data and market trends to identify promising opportunities. They understand that accurate and timely information is crucial in making informed decisions.

To maximize potential gains, it’s vital to grasp the significance of diversification. Picture a balanced portfolio like a well-tended garden, flourishing with a variety of investments that can mitigate risks and enhance returns. Each asset—stocks, bonds, or mutual funds—plays a unique role, creating a vibrant ecosystem of financial growth.

Moreover, staying abreast of market changes is essential. The investment landscape can shift dramatically, and timely information can be your compass. By utilizing trusted resources, you can navigate these tides with agility and confidence.

In essence, the journey to successful investing hinges on knowledge, diversification, and adaptability. Equip yourself with the right tools and insights, and watch your investment landscape transform. Embrace the adventure—your financial future awaits!

Unlock the Secrets to Smart Investing Today!

- Investing requires a strategic approach, not just a focus on past performance.

- Thorough analysis of data and market trends is key to identifying valuable investment opportunities.

- Diversification is crucial—maintaining a balanced portfolio reduces risk and enhances potential returns.

- Each type of asset contributes uniquely to your financial growth, similar to a diverse ecosystem.

- Stay updated on market changes to adapt your strategies effectively and seize new opportunities.

- Empower yourself with knowledge and tools to confidently navigate the investment landscape.

Unlock Your Investment Potential: Essential Insights for Savvy Investors

Navigating the Investment Landscape

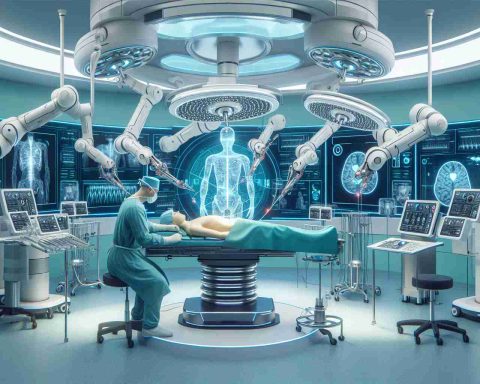

Investing today involves multifaceted strategies that go beyond traditional methods. With the rise of technology, robo-advisors and AI-driven analytics have become popular, providing personalized investment strategies and real-time market analysis, making investment accessible to a broader audience.

Key Trends:

1. Sustainable Investing: Investors are increasingly focusing on Environmental, Social, and Governance (ESG) criteria, reflecting a growing commitment to sustainability.

2. Decentralized Finance (DeFi): This trend is transforming traditional financial systems, enabling peer-to-peer financial transactions that bypass centralized intermediaries.

3. Artificial Intelligence: AI plays a crucial role in developing predictive algorithms that can help investors make better-informed decisions.

Important Questions and Answers

Q1: What is the significance of diversification in investing?

A1: Diversification reduces risk by spreading investments across various asset classes. It helps mitigate potential losses in one area with gains in others, leading to a more stable portfolio.

Q2: How do market trends influence investment strategies?

A2: Market trends provide insights into economic conditions and consumer behavior. Successful investors use this data to anticipate market movements and adjust their portfolios accordingly to maximize returns.

Q3: What role does technology play in modern investing?

A3: Technology enhances investment decision-making through tools like robo-advisors, real-time data analysis, and AI algorithms, enabling investors to make informed choices quickly and efficiently.

For those eager to dive deeper into the world of investing, I recommend exploring more about these trends and technologies at Investopedia. Stay informed, stay strategic, and let the currents of investment work in your favor!